See Myself Starting to Get Worse Again Tweet

Justin Sullivan/Getty Images News

Tesla'south (NASDAQ:TSLA) stock has suffered recently with the company's market place cap dropping to less than $900 billion, subsequently pressure from Elon Musk's Twitter (TWTR) investment and potential stock sales. Investors might be fooled into thinking that this curt-term downturn from stock sales represents an investment opportunity, even so, as nosotros'll meet, Tesla all the same remains significantly overvalued.

Tesla Book Ramp

Tesla'south power to continue succeeding is based on ramping volume and succeeding with new models.

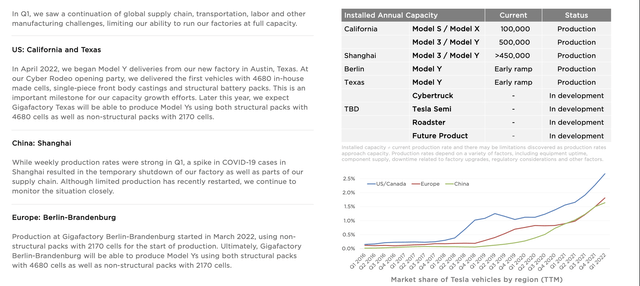

Tesla Book Ramp - Tesla Investor Presentation

The visitor has been ramping up volume although its Shanghai manufacturing plant has suffered from COVID-19 volatility. Nevertheless, information technology'southward worth noting that the visitor's factories and focused capacity for the Model S/X/3 are effectively done. The company could ramp upwards the Model Y or other time to come projects, however, it shows the company sees demand for other vehicles as peaked.

An example of this can be seen on Tesla's website. The cheapest Model iii has an estimated delivery date of Aug-November 2022. The top end has a Jun-Aug 2022 commitment engagement. The summit end Model Y is Jul-Sep 2022. The company's backlog has decreased substantially from its prior backlogs, and particularly with the potential for a weaker market, nosotros see that weakness continuing.

With competition increasing significantly, we view Tesla's volume ramp equally slowing down. It's telling that the visitor doesn't have any new factories planned for its Model iii/S/10.

Tesla Energy Storage/Alternatives

Tesla has numerous alternative businesses including energy storage and other alternative businesses.

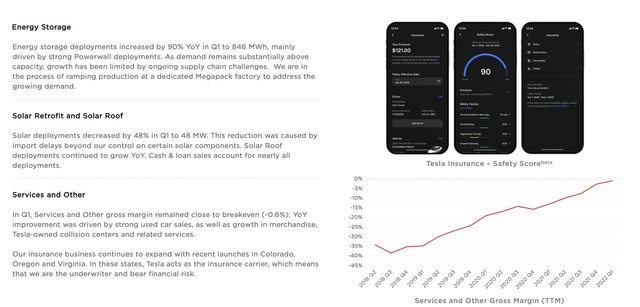

Tesla Alternative Businesses - Tesla Investor Presentation

The company's free energy storage business is the bright spot in its alternatives business. The company has seen deployments increase 90% YoY. Yet, the company does have some risks to the business here. First, energy storage is a worse use of capital from a profit perspective versus building cars. Tesla itself has admitted that earlier.

That ways that equally long as there'southward volume demand for the company's cars, the visitor's energy storage volition take a dorsum seat. Second is the company's solar business. We've discussed this before, but this business concern is negligible. It's decreasing in size, has a single-digit market place share and no competitive reward.

Tesla Insurance

Another evolution for Tesla is the visitor's annunciation that it's launching an insurance business.

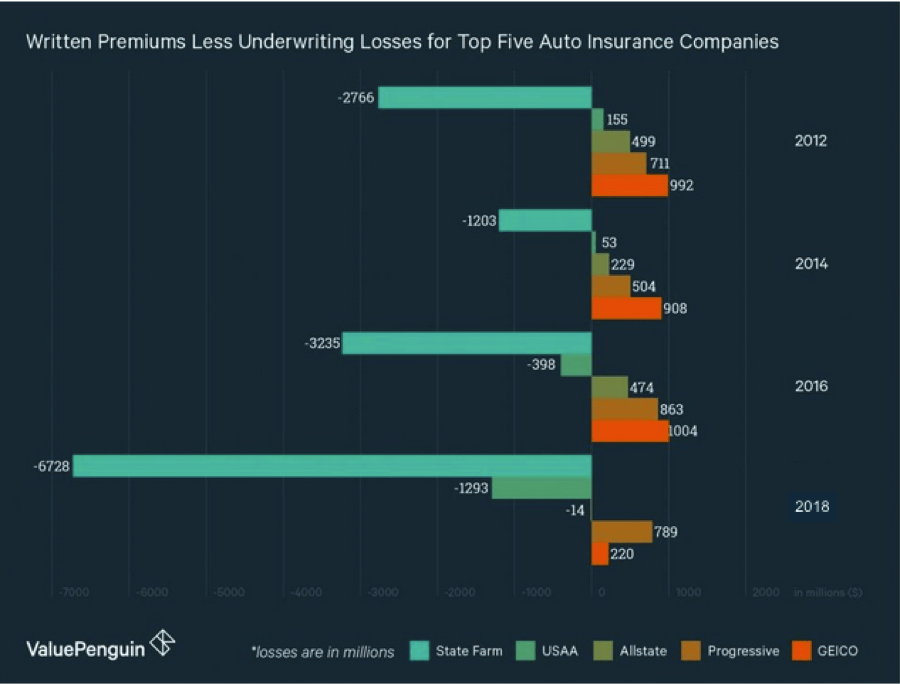

Insurance Underwriting Results - PMR Police

Insurance isn't a high profit margin business. It relies on the generation of the float and the potential investments of the float to generate returns. A substantial insurance business tin take advantage of a continuous float to invest and generate long-term returns without a significant negative bear on to that bladder.

The takeaway here is that insurance companies operate off of calibration. Travelers is the 10th largest insurance company in the globe, insures more than than 2 million vehicles. Fifty-fifty with 100% of U.S. Tesla owners getting insurance through Tesla, the company won't reach that number. More so, even if it did, the insurance business would only be valued at a few billion $ based on peers.

Warren Buffett whose Berkshire Hathaway owns GEICO recently commented they don't look Tesla to outperform here, given their information is mostly the aforementioned as the current insurers. Here, we believe the contrary is truthful. Not only will Tesla not outperform simply the company could lose money or, in the issue of a fault, hurt a brand. We encounter three unique downsides for the company.

(1) Multi-line discount. Most major insurers offering to bundle home insurance with multiple cars, home insurance, umbrella insurance, etc. Tesla can't offer those discounts to customers meaning that offering competitively priced insurance will be more than difficult.

(two) Reputation. It's no surreptitious that Americans hate their insurance providers. Unfortunately, the premise of maximizing profits for the insurer is unlike from maximizing profits for the insuree. And oftentimes those competing interests come to clash at a tough fourth dimension. Tesla will need to outperform its customers because of the reputational risk.

Someone who has a bad experience with Tesla insurance might leave Tesla overall. No one buys a dissimilar car because they dislike Progressive.

(3) Start Upwardly Price. Insurance is a crowded market without a loftier barrier to entry. However, Tesla will be spending substantial money to startup and join the manufacture. The company will be spending cost with no guarantee of returns, which is a hazard for the company's future shareholder returns.

Tesla and Tech, A Unique Downside

We want to take the opportunity to highlight what we see equally a unique chance for Tesla. The visitor is a massively popular machine amid tech manufacture employees. The carmaker has a >10% market share in California versus a ii% market share in the U.s.a.. It's well known in the hub of the technology industry how popular the company's cars are.

Withal, we run into this as a unique potential downside for Tesla. The company's cheapest cars clock in at 2x the cheapest car from the traditional depression-cost manufacturers (Honda and Toyota) every bit the company has struggled to meet expectations. Fifty-fifty versus luxury manufacturers such every bit BMW and Mercedes, the company's cheapest car is more expensive.

More than so, the tech industry has suffered. After leading the bull market for the last 5 years, the market is now down roughly 25%. Given Tesla's unique positioning to tech industry employees, we expect the downturn will injure the demand for the company's products, specially higher cease products.

Tesla Isn't Recession Proof

Tesla has reasonably strong cash and cash equivalents at roughly $xviii billion. Nonetheless, the car industry is incredibly capitally intensive, and losses ramp up significantly during a market downturn.

Through the 2008 recession, U.S. carmakers lost $10s of billions. Capitol obligations can be difficult to avoid in the manufacture with factories needing to exist kept running because the cost of shutting them off is fifty-fifty more expensive. Even so, that doesn't hateful that they're making a profit. Tesla hasn't actually had to face a market downturn yet.

We await there are ii factors here that will over again make Tesla less likely to survive a recession.

(i) People cut spending during a recession. Tesla is effectively a luxury brand at its pricing. In 2008, Toyota outperformed. During an upcoming recession, nosotros wait Tesla to similarly underperform in line with luxury brands. They likewise might be less willing to try the doubt of an electric vehicle.

(2) Capital growth. Tesla is focused on growing essentially, and every bit we saw above, has numerous factories that information technology's planning to build. Those capital obligations without production could cause the company to take higher losses than companies only maintaining existing factories. That hazard is worth paying close attending to.

Thesis Take a chance

The largest risk to our thesis is that Tesla is a unique visitor that has a proven ability to outperform. The company, in many ways, defined electric vehicles every bit a segment, especially luxury vehicles, and the company'southward competitors have struggled to compete. At that place's no guarantee that the company can't continue increasing market place share and returns.

Decision

Tesla is now twoscore% below its 52-calendar week highs. The visitor's weakness was exacerbated by Elon Musk'south ownership and his pledging of the company's stock confronting his Twitter acquisition. That sell-off accelerated as a upshot of the general technology sell-off in the markets. Despite this underperformance, we see that as but the showtime.

The company is showing pinnacle demand with no additional factories planned for the Model S/10/3. About vehicle purchases tin can run into commitment with is shorter delays than other manufacturers' vehicles such as Toyota's RAV4. We also view the company's position in the tech markets every bit a unique risk to its business model. As a result, we continue to recommend against investing in Tesla.

Create a High-Yield Portfolio Using Unique Investment Strategies, 2-Calendar week Trial!

The Energy Forum helps you invest in energy, generating strong income and returns from a volatile sector. Our included Income Portfolio helps yous invest in the broader market, finding high-yield non sector-specific opportunities.

Recommendations from a superlative 0.5% writer on TipRanks!

Worldwide free energy demand is growing and you tin can exist a office of this profitable tendency. Plenty of unique nether the radar opportunities remain.

Nosotros provide:

- Model energy and marketplace portfolios generating high-yield income.

- Deep-dive actionable research.

- Macroeconomic overviews.

- Summaries of recommendations and pick strategies.

Click for our ii-week trial, with 47% off!

Source: https://seekingalpha.com/article/4512479-twitter-tesla-downturn-is-merely-start

0 Response to "See Myself Starting to Get Worse Again Tweet"

Post a Comment